The modern trader demands more than just a platform for buying and selling. They require low latency, raw pricing, and the ability to diversify across multiple asset classes from a single account.

StriveFX was built to address these needs by focusing on execution efficiency. Rather than acting as a traditional market maker, they emphasize a transparent trading environment where technology drives performance, catering to everyone from manual scalpers to algorithmic developers.

What is StriveFX?

StriveFX is an online multi-asset CFD broker that operates on an Electronic Communication Network (ECN) model. Unlike traditional market makers that profit from client losses, StriveFX positions itself as a neutral intermediary, routing client orders directly to top-tier liquidity providers.

Registered in Anjouan under the Comoros Financial Services Authority, the broker focuses on providing high-frequency, low-latency execution environments suitable for algorithmic traders, scalpers, and those seeking diverse market exposure.

- Company name: StriveFX

- Company number: 15978

- License number: L15978/SFX

The firm’s stated mission is to “lead the next wave of online trading” by combining technology, transparency, and client support. Its website describes three core values: integrity, innovation, and client focus.

Is StriveFX Regulated and Safe?

Safety and security are paramount when choosing a broker. StriveFX operates under the supervision of the Comoros Financial Services Authority (CSF) with license number L15978/SFX.

To ensure client protection, they implement rigorous safety protocols:

- Segregated Accounts: All client funds are held in separate bank accounts, distinct from the company’s operational capital.

- Negative Balance Protection: A vital safeguard that ensures you can never lose more than your initial deposit, regardless of market volatility.

- Data Security: The platform adheres to PCI DSS standards and uses advanced encryption to protect personal and financial data.

StriveFX Account Types

StriveFX offers a simplified account structure designed for users of different experience levels. Unlike complex tier systems, they offer three main variations based on deposit size and cost structure.

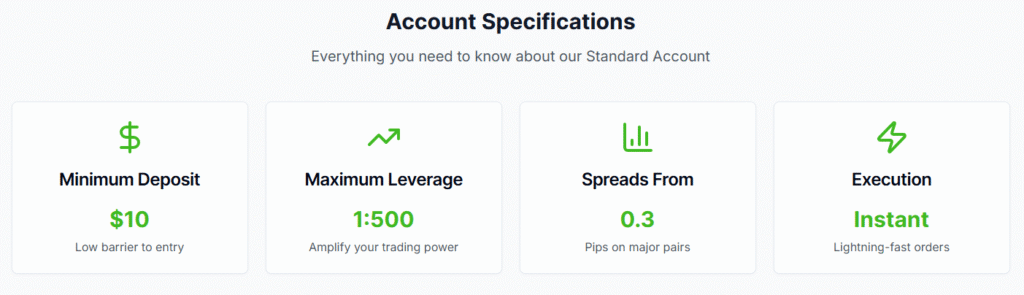

1. Standard Account

Designed for beginners and casual traders who prefer simplicity over raw spreads.

- Minimum Deposit: $10

- Spreads: From 0.3 pips

- Commission: $0 (Commission-Free)

- Leverage: Up to 1:500

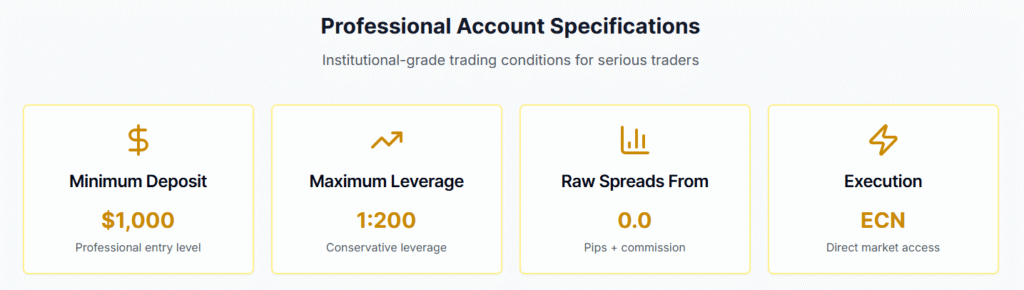

2. Professional Account

This is the flagship offering for serious traders, scalpers, and algo-developers.

- Minimum Deposit: $1,000

- Spreads: Raw from 0.0 pips

- Commission: $7 per lot (Round Turn)

- Leverage: Up to 1:200

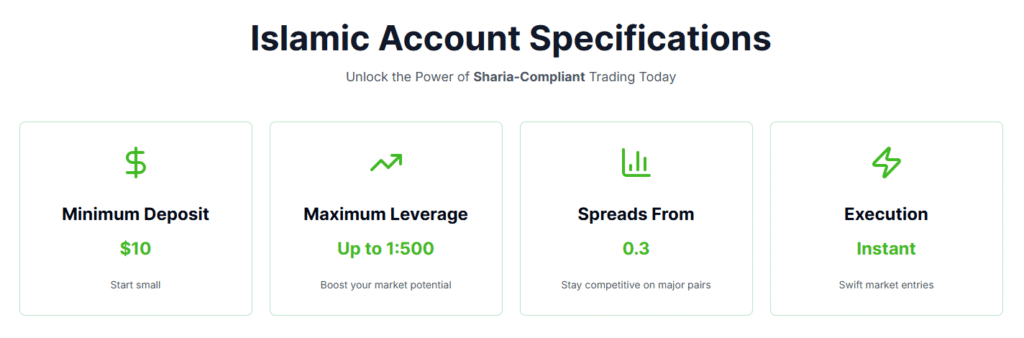

3. Islamic Account

A swap-free option for traders adhering to Sharia principles.

- Swap Fees: $0 (for the first 5 days)

- Admin Fee: Applied after day 5

- Conditions: Mirrors the Standard account execution.

4. Demo Account

A completely risk-free environment designed for strategy testing, algorithm back-testing, and platform familiarization without financial commitment.

- Virtual Balance: $100,000 (Reloadable)

- Conditions: Mirrors live market execution and spreads

- Availability: Unlimited access on both cTrader and Match-Trader

- Cost: 100% Free

Trading Platforms

StriveFX offers two modern platforms that prioritize speed and transparency.

cTrader

The “gold standard” for ECN trading. cTrader offers:

- Level II Pricing: View the full Depth of Market (DOM) to see available liquidity.

- cTrader Automate: A native environment for building robots in C#.

- Server-Side Trailing Stops: Advanced risk management that works even when your computer is off.

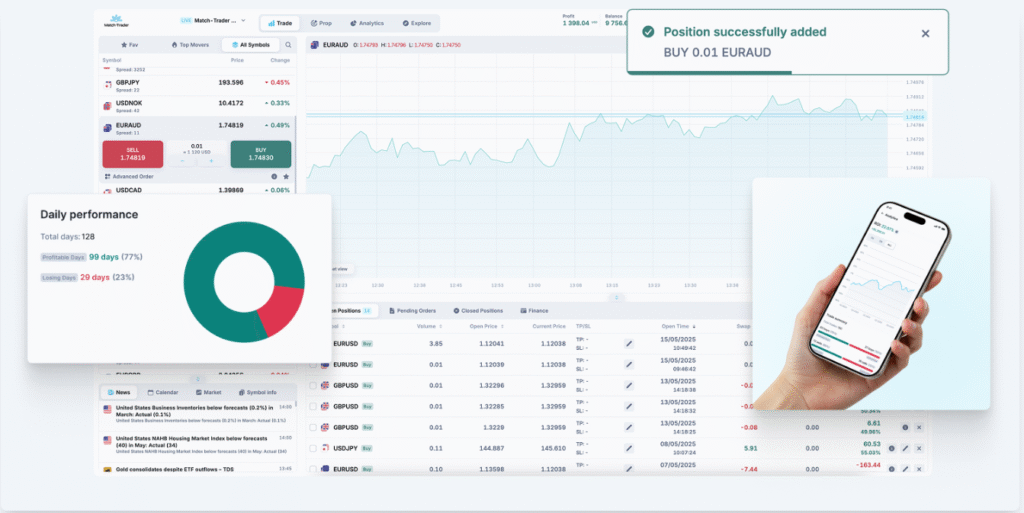

Match-Trader

A proprietary platform built for accessibility.

- Unified Interface: Syncs ideally between mobile and desktop.

- Lightweight: Ideal for trading on slower connections or mobile devices without lag.

Trading Assets and Instruments

One of StriveFX’s strongest selling points is its market depth. The broker offers access to over 10,000 instruments, allowing for proper multi-asset diversification.

- Forex: 70+ pairs (Majors, Minors, Exotics).

- Indices: Global benchmarks (US30, NAS100, GER40) with pre-market trading.

- Crypto: 24/7 trading on Bitcoin, Ethereum, Solana, and more.

- Commodities: Gold, Silver, Oil, Corn, Coffee.

- Bonds: US Treasuries (10Y, 30Y) and European Bunds.

Leverage and Trading Conditions

- Leverage: StriveFX offers up to 1:500 leverage on the Standard account. This is significantly higher than the 1:30 cap found in Europe, making it attractive for traders with smaller accounts.

- Execution: As an ECN broker, execution speeds are clocked in milliseconds. The lack of a dealing desk means no requotes during normal market conditions.

- Scalping: Fully permitted. The 0.0 pip spreads on the Professional account make this an ideal environment for high-frequency scalping strategies.

Deposit and Withdrawal Methods

StriveFX supports a modern array of funding options to ensure global accessibility.

- Deposit Methods: Credit/Debit Cards (Visa/Mastercard), Wire Transfer, and Cryptocurrencies (USDT, BTC).

- Withdrawal Speed: Crypto withdrawals are typically processed within 24 hours. Wire transfers may take 3-5 business days, depending on the banking network.

- Fees: StriveFX does not charge hidden deposit fees, though blockchain network fees may apply for crypto transactions.

Customer Support

Support is available 24/7 via:

- Live Chat: Instant response for technical issues.

- Email: Ticket system for account inquiries.

- Multilingual: Support is offered in multiple languages to cater to their global client base.

During our testing, Live Chat response times were under 2 minutes, and agents were knowledgeable about technical platform queries.

Pros and Cons

The Pros

- Raw ECN Spreads: The Professional account offers real 0.0-pip spreads, which are key for profitable scalping.

- Low Barrier to Entry: You can start trading live with just $10 on the Standard account.

- Diverse Assets: Access to Bonds and over 10,000 instruments is superior to most standard Forex brokers.

- cTrader Integration: Access to one of the world’s most advanced trading platforms.

- High Leverage: Up to 1:500 leverage enables efficient capital utilization.

The Cons

- Islamic Account Fees: While swap-free, the Islamic account incurs an administrative fee on positions held longer than 5 days.

- Professional Deposit: The $1,000 minimum for the Raw spread account may be steep for absolute beginners.

- Bonus Rules: Promotional credits often have strict volume requirements before they can be withdrawn.

Final Verdict: Is StriveFX Worth It?

StriveFX is a “power user” broker. It strips away the marketing fluff to focus on what matters: Execution Speed, Platform Stability, and Asset Diversity.

If you are an algorithmic trader using cTrader or a scalper who needs 0.0-pip spreads, StriveFX offers a superior environment compared to many standard retail brokers. The inclusion of Bonds and 24/7 Crypto trading also makes it a fantastic hub for diversified portfolio management.However, the $1,000 minimum for the Professional account makes it best suited for intermediate-to-advanced traders who understand risk management and want to avoid the restrictive leverage caps of European brokers.